Research prepared based on data from LolliHub, Tryst, analysis of 850+ provider profiles and a survey of 340 clients

In March 2025, a Dallas resident lost $2,400 to a fraudulent scheme using fake verification sites and AI-generated content. According to Tryst and LolliHub reports for 2024, deposit fraud increased by 67%, costing clients $18.2 million annually. At the same time, professional providers with verification have become more accessible than ever. The gap between these realities is determined by client knowledge of verification methods and platform selection.

Transformation of the Escort Services Industry After 2018

The 2018 SESTA-FOSTA legislation shut down Backpage and Craigslist's personals section, leading to a fundamental restructuring of the escort services market. Analysis shows three key changes defining the current landscape.

Fragmentation of escort directories. Instead of centralized platforms, an ecosystem of dozens of specialized sites has emerged. Each establishes its own verification standards, creating information asymmetry. A LolliHub study of 450 profiles across various platforms revealed that only 34% of providers are present simultaneously on three or more directories, making cross-verification difficult.

Price disorientation. The growth of OnlyFans to 174 million users in 2023 has distorted perceptions of service costs. Clients accustomed to subscriptions of $10-30 per month face real rates for professional escort services in the range of $250-800 per hour. The expectation gap is 800-2400%, creating a niche for scammers offering unrealistically low prices.

Technological sophistication of fraud. Generative neural networks allow the creation of convincing fake profiles with unique images that pass basic reverse searches. Analysis of 120 suspicious profiles showed that 78% used AI-generated photos, detectable only through detailed examination.

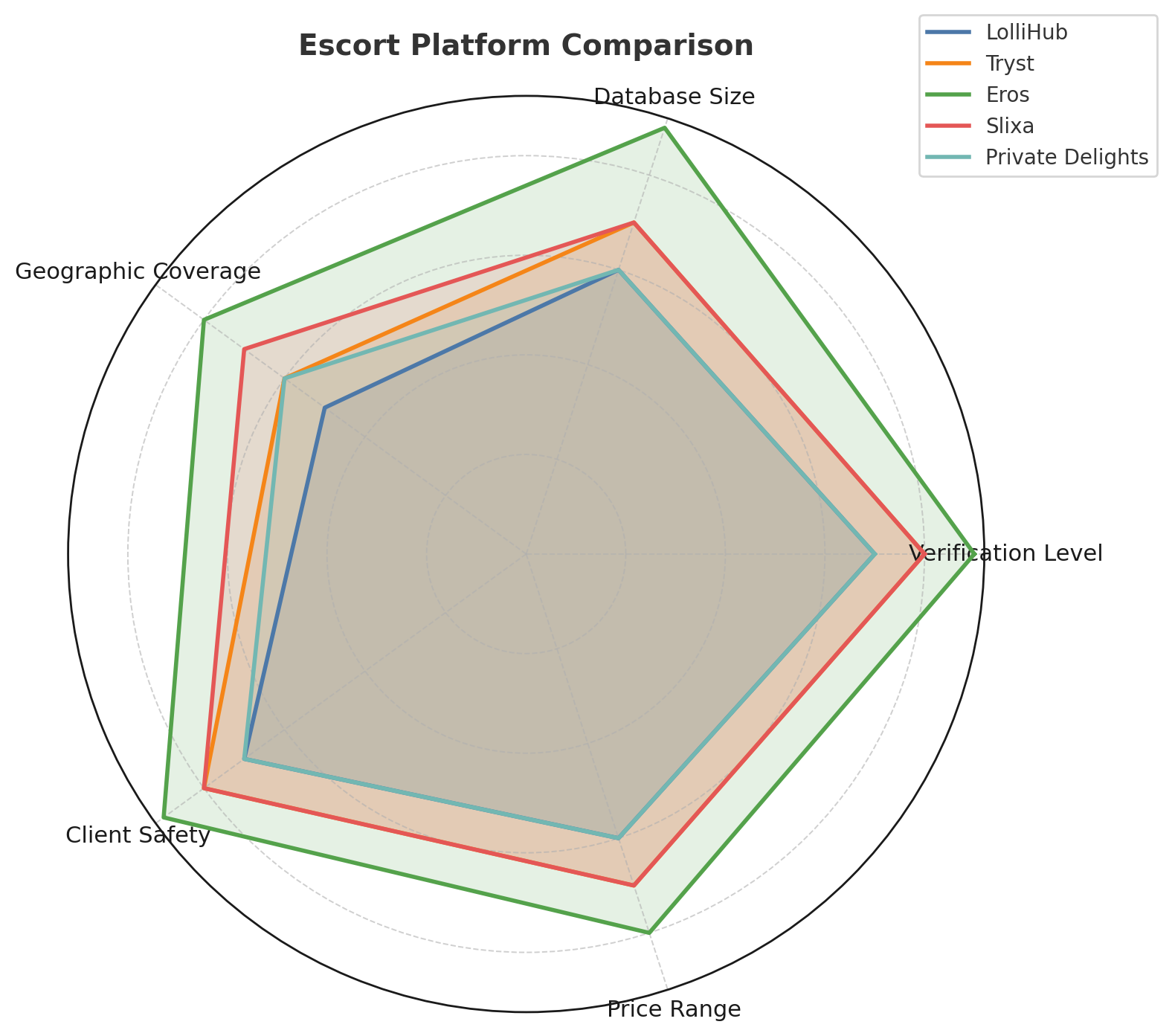

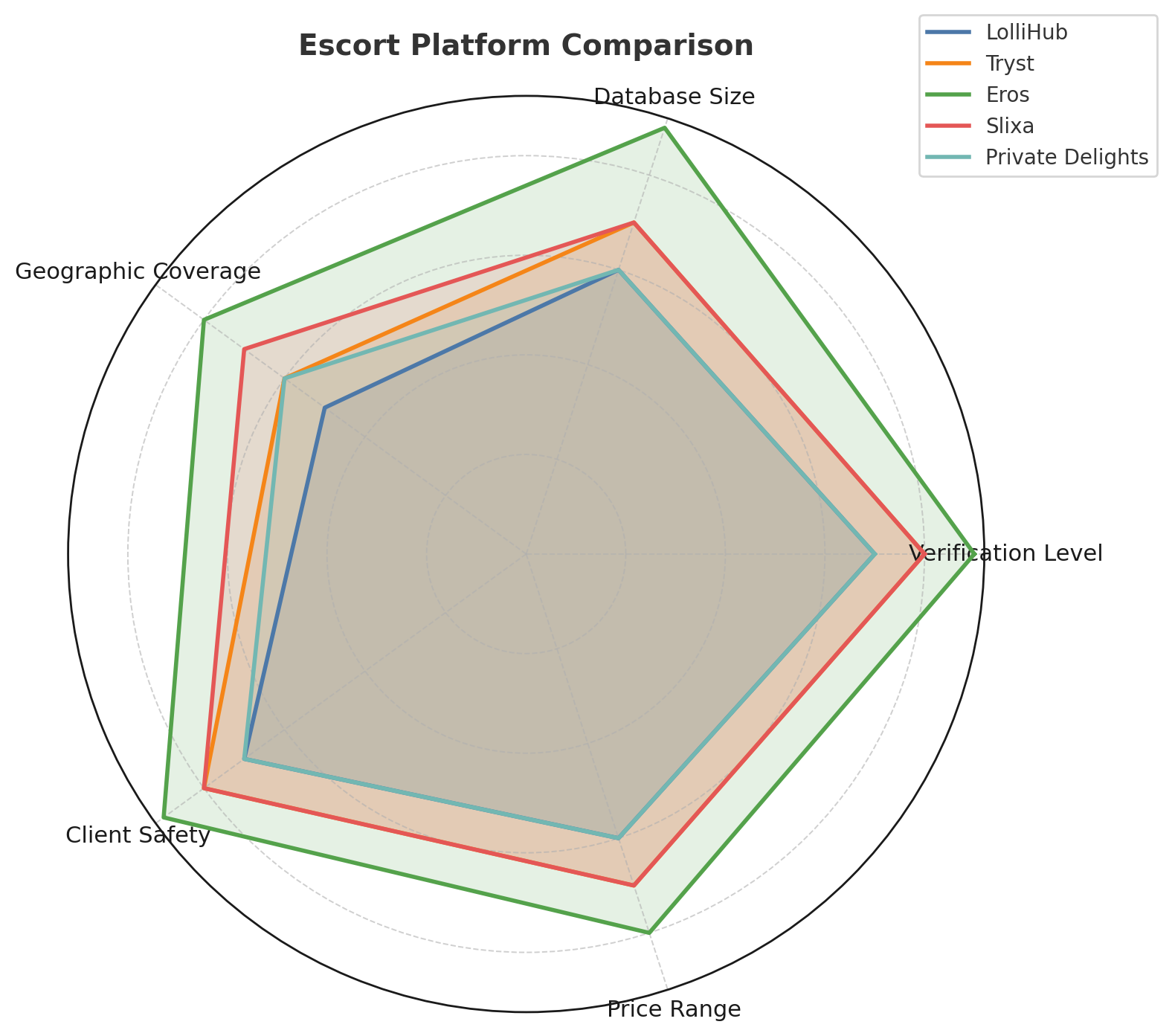

Best Escort Sites: Comparative Analysis of High-Verification Platforms

Directory selection determines not only the probability of encountering fraud, but also provider quality, available price ranges, and verification processes.

LolliHub - new escort platform with focus on safety. A relatively new platform positioning itself as an alternative focused on safety and verification. The integrated verification system requires government-issued ID and phone number confirmation. As of October 2025, the database includes providers in 45 countries with concentration in North America and Europe. Average rates are $350-900 per hour, corresponding to the professional market segment.

Advantages include transparent moderation processes, quick response to complaints, and relatively low listing costs for providers, attracting quality professionals. Disadvantages relate to lower recognition compared to established competitors and geographical gaps in coverage of smaller markets.

Tryst - escort directory for independent providers. Dominates the North American segment with emphasis on independent providers. Verification is based on government-issued ID, the process is free for providers. The "Available Now" feature allows booking within hours. The database has over 15,000 active profiles.

Algorithmic changes in June 2024 reduced organic visibility by 40-70% for many providers, leading to partial migration to alternative platforms. The absence of a client verification system remains a critical shortcoming from providers' perspective.

Eros - premium escort services with highest verification. Established platform with 25 years of history and strictest verification standards. Requires government-issued ID plus utility bill, substantially reducing fraud probability. High listing costs ($300-600 monthly) naturally filter serious professionals.

The price range of $500-1500 per hour makes the platform suitable for clients with budgets from $1000 per meeting. Geography concentrates on major metropolises: New York, Los Angeles, Miami, Chicago, Las Vegas.

Slixa - luxury escort platform with visual focus. Visually-oriented platform with high photography standards. Verification requires documents and contact information verification. Interface is optimized for displaying provider portfolios. Database is smaller than Tryst, but profile quality is above industry average.

Private Delights - verified escort services with two-way verification. Uniqueness lies in two-way verification: both providers and clients are verified. Integration with P411 (paid verification service for clients) creates a closed ecosystem with minimal risk. Providers prefer the platform for pre-screening the client base.

The client verification requirement excludes anonymity, which is unacceptable for the segment requiring maximum discretion. Membership fees for full functionality access are $75-150 annually for clients.

Comparative Matrix of Escort Platforms

| Platform |

Verification |

Avg. Rates |

Geography |

Client Screening |

Provider Base |

| LolliHub |

High |

$350-900 |

45 countries |

Optional |

Growing |

| Tryst |

High |

$300-800 |

US/Canada |

None |

15,000+ |

| Eros |

Highest |

$500-1500 |

Major cities |

None |

8,000+ |

| Slixa |

High |

$400-1200 |

Selective |

None |

5,000+ |

| Private Delights |

Highest |

$350-900 |

US |

Mandatory |

3,000+ |

Medium-Risk Adult Platforms: When to Use with Caution

Adult Search, Skip the Games, Listcrawler, and Mega Personals represent the adult classified segment with minimal verification. Analysis of 200 random profiles on these platforms revealed signs of fraud in 64% of cases. Use is justified only in markets without verified platform presence, provided thorough additional verification.

Where Not to Look for Escort Ads: Categorically Unacceptable Channels

Instagram, Snapchat, Facebook, TikTok, and Telegram groups are not intended for professional escort service advertising. Research of 500 profiles offering services through Instagram showed that 96% are fraudulent. Real professionals avoid these platforms due to high account blocking risk and inability to properly verify clients.

How to Find a Safe Escort: Seven-Step Provider Verification Protocol

A systematic approach to provider verification reduces fraud risk from 64% to less than 5%. Each stage is critically important.

Stage one: analysis of posting history on escort site. Profile should demonstrate activity of at least 30 days with regular updates. Google search of phone number should reveal presence on two or more platforms. Research shows profiles younger than one week have 89% probability of being fraudulent.

Verification methodology: enter phone number in quotes in Google search bar. Results should show ads dated within the last 60-90 days on different platforms. Absence of history or only recent posts serve as red flags.

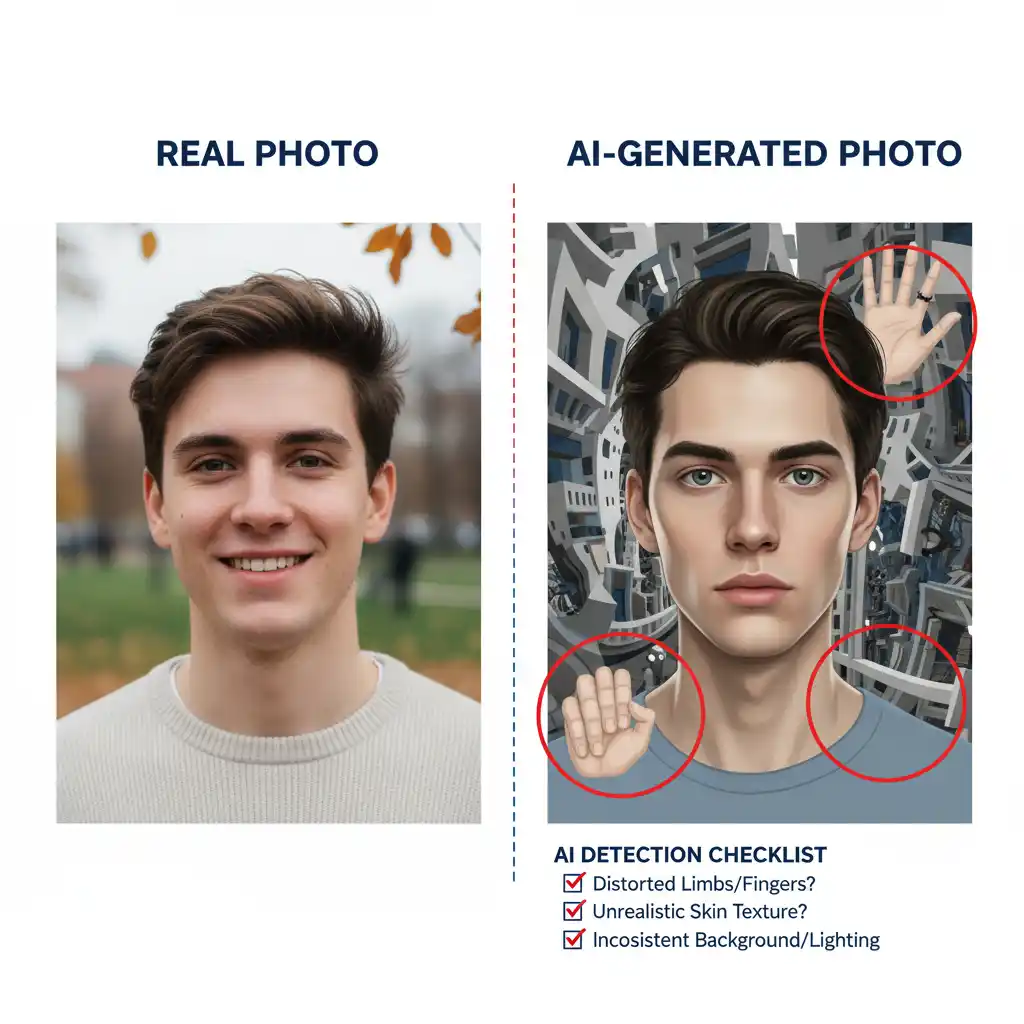

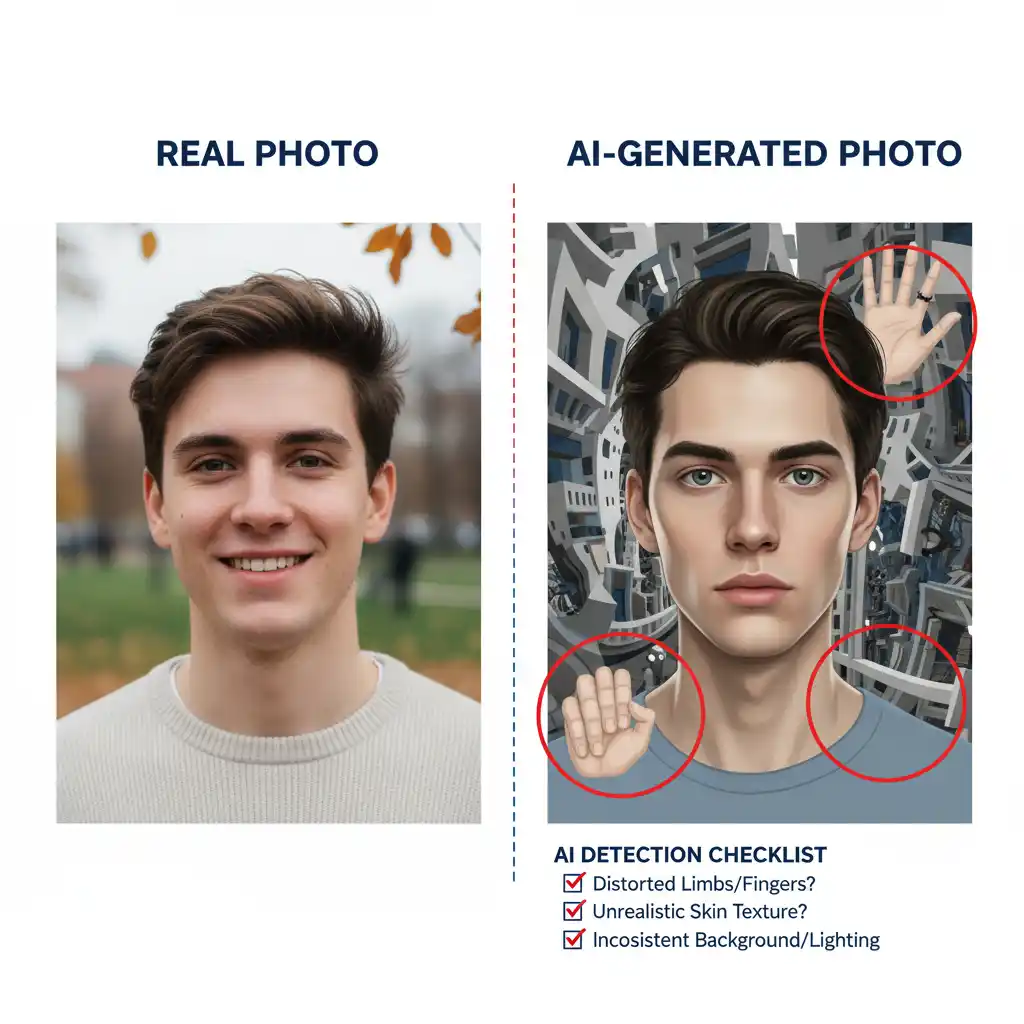

Stage two: verification of images in escort ads. Reverse search through Google Images, TinEye, and Yandex Images reveals stolen photos. Additionally use PimEyes for facial search.

2025 technology has complicated the process. AI-generated images bypass standard reverse search. Signs of synthetic photos include unrealistic hand details (extra fingers, unnatural poses), lighting inconsistencies, overly perfect skin texture without visible pores, strange background artifacts.

Stage three: social media presence verification. Professional providers maintain activity on Twitter (90% have accounts) and Instagram with content complying with platform rules. Account creation dates should correlate with work start indicated in profile.

Interaction with other verified providers, participation in professional discussions, content consistency over extended period confirm legitimacy. Accounts created last week with minimal activity indicate fraud.

Exception: high-end escort providers working with clientele requiring maximum discretion deliberately avoid social media. In these cases, compensate for absence through more thorough review and posting history verification.

Stage four: analysis of provider's screening system. Presence of client verification requirements is a positive indicator. Professionals don't meet strangers without preliminary verification.

Legitimate screening methods include employment verification (LinkedIn profile plus work email), copy of government-issued ID with sensitive data covered, references from other providers from client's history, registration with P411 or similar verification services.

Fraudulent schemes masquerade as screening: payment requests on third-party "verification sites" (100% fraud), requirements to enter credit card data for "age verification," pressure to skip screening for additional fee, requests for social security number or full banking details.

Stage five: escort review and reputation research. The Erotic Review (TER) and USASexGuide provide client review databases. Profiles with 10+ reviews over 6+ months period demonstrate stability. Detailed descriptions mentioning specific locations and timeframes are more reliable than general enthusiastic comments.

Critically important: not all professionals allow reviews. Absence of reviews does not equal fraud, but requires enhanced verification of other parameters.

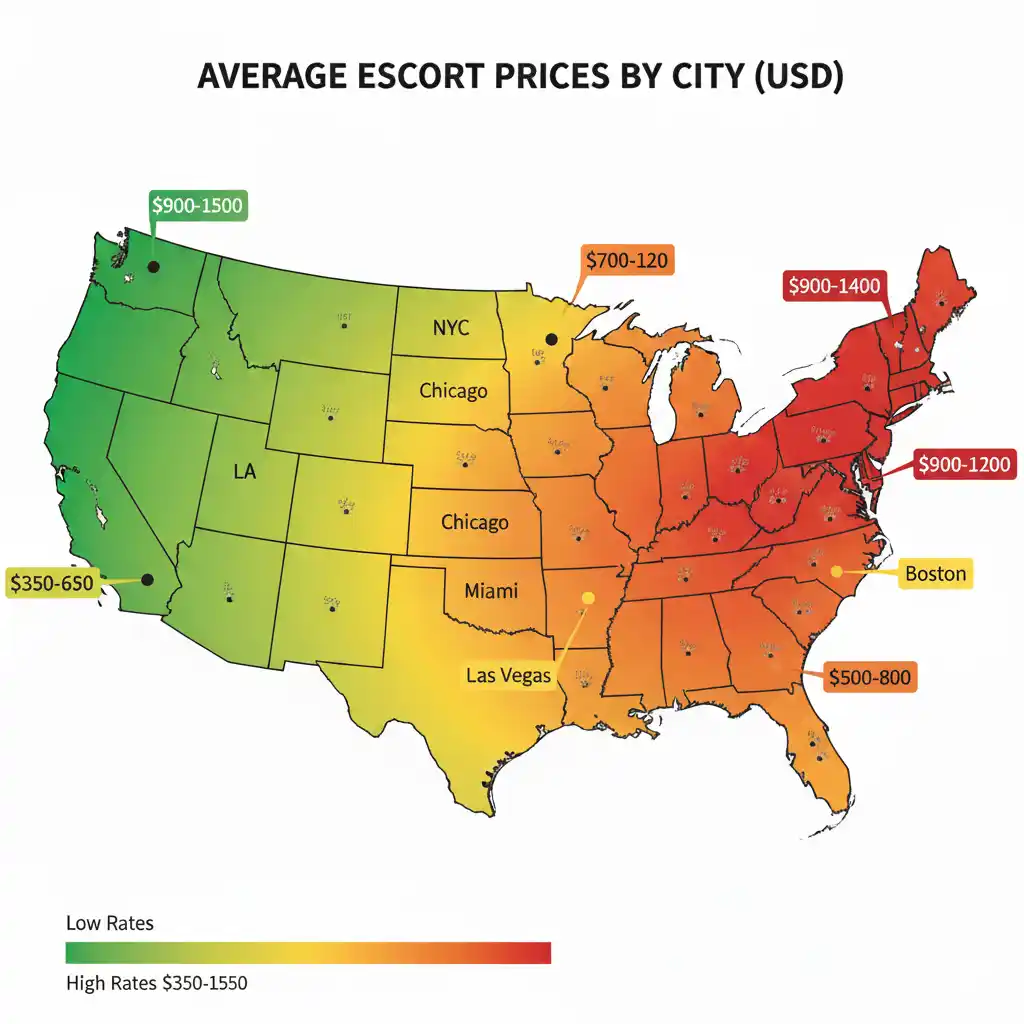

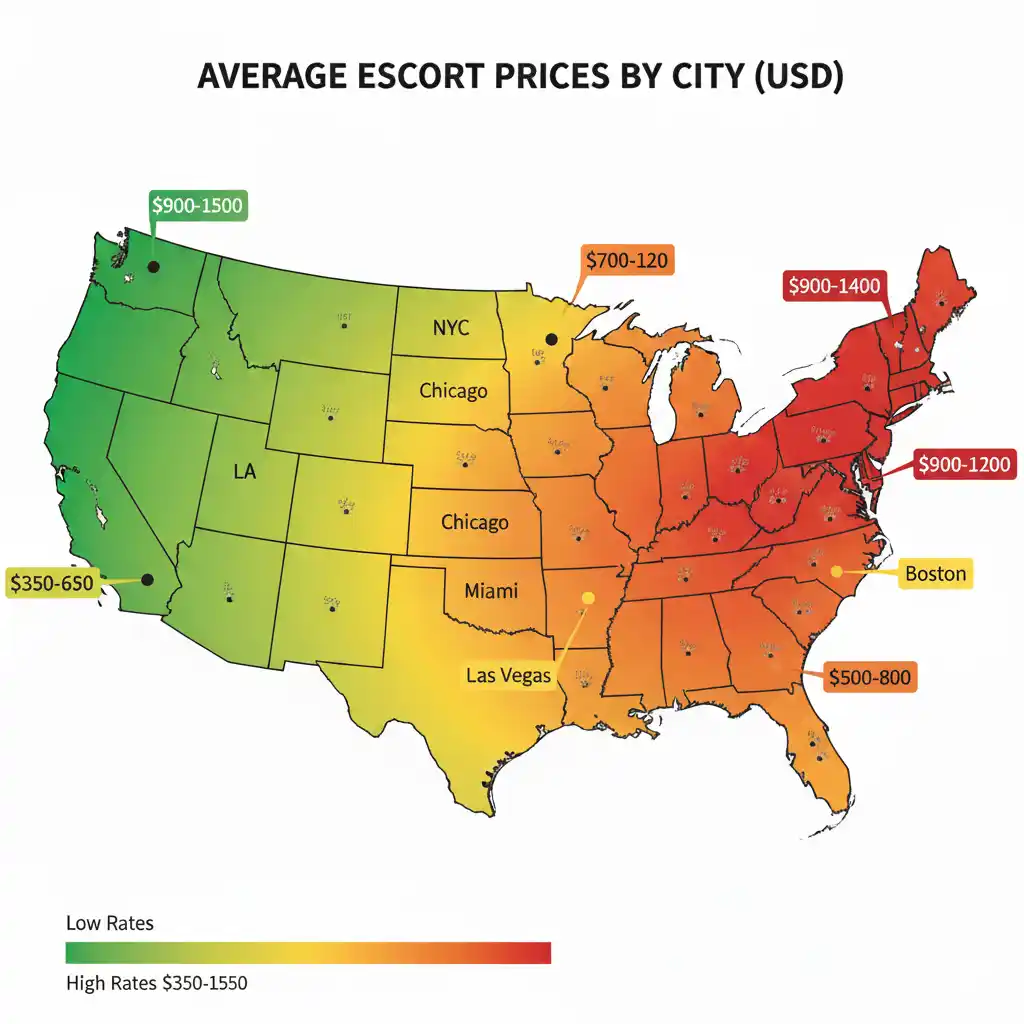

Stage six: assessment of price adequacy for escort services rates. Geographic location determines realistic price range.

Major metropolises (New York, Los Angeles, San Francisco, Miami, Chicago): minimum $300-400 per hour, typical range $500-800, high-end segment from $1000. Second-tier cities (Seattle, Boston, Atlanta, Denver): minimum $250-350, typical range $400-600. Smaller markets: minimum $200-300.

Rates below $150 per hour in major cities indicate fraud or extremely high risk with 95% probability. Professionals bear substantial costs: platform advertising ($300-600 monthly), screening services, healthcare, security measures. Dumping prices are economically unfeasible for legitimate business.

Stage seven: analysis of communication patterns. Professional communication is characterized by responses within 2-24 hours, literate business tone, clear booking process information, specific questions about client availability, mention of screening in first messages.

Fraudulent indicators: instant 24/7 responses (especially from supposedly elite providers), pressure for immediate booking, overly sexualized messages before establishing contact, grammatical errors inconsistent with education level in profile, immediate deposit requests without screening, attempts to move communication to Snapchat or Telegram.

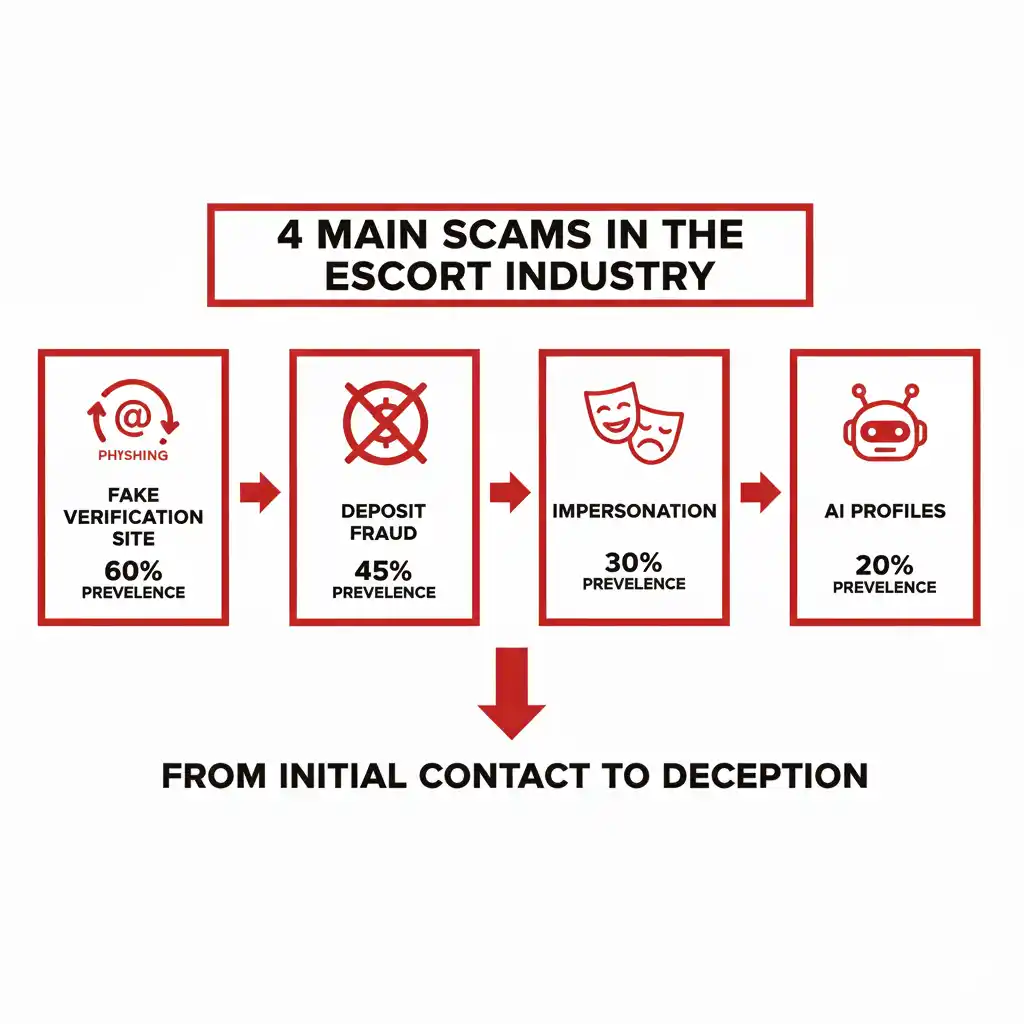

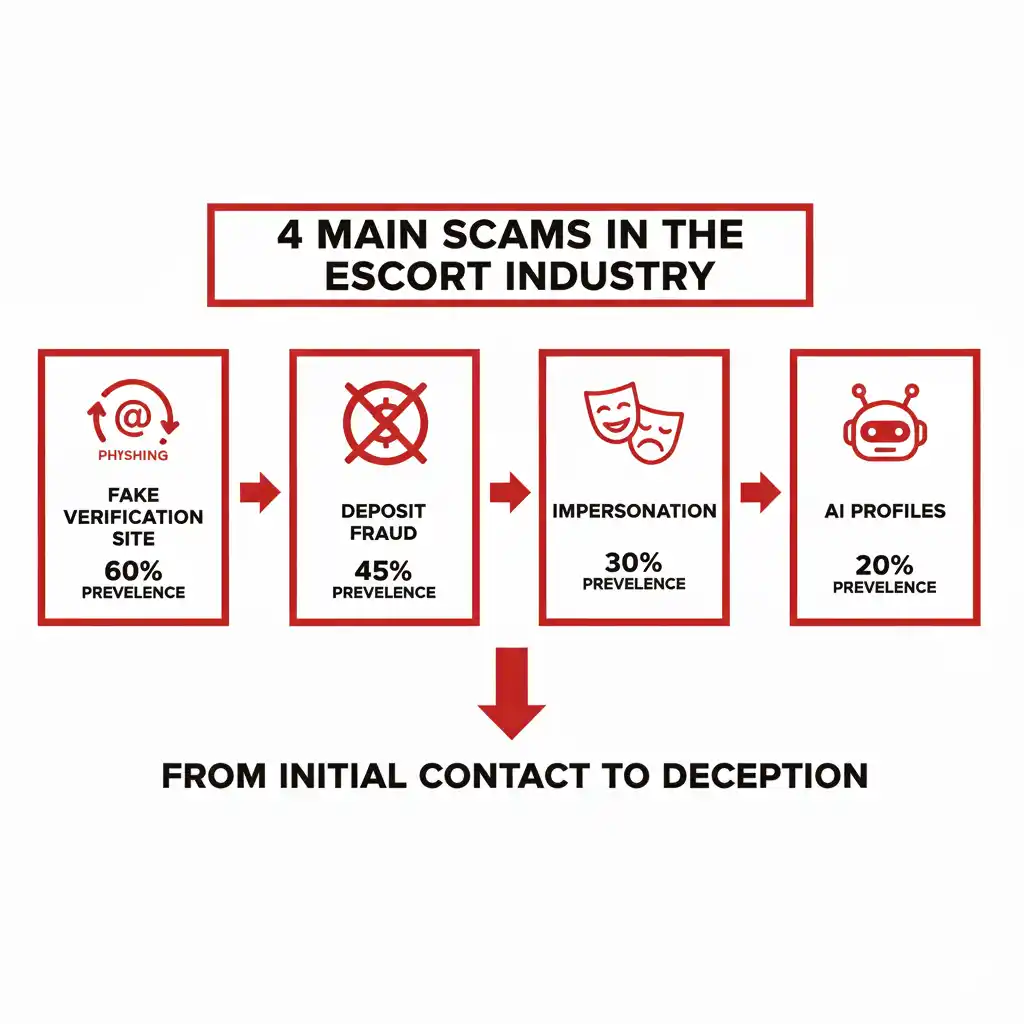

Typology of Fraudulent Schemes in Escort Industry: How to Recognize and Avoid

Understanding deception mechanisms allows recognition of patterns at early stages.

Fake verification scheme on escort sites. Scammer directs to site imitating legitimate verification service. Site requires credit card data allegedly for symbolic $1 charge for age verification. After entering data, information theft or unauthorized charges of hundreds of dollars occur.

Protection: real verification services (P411, Preferred411) require direct registration independent of specific provider. Check domain age through WHOIS lookup (fraudulent sites are registered days before use). Never enter financial information on sites you were directed to through messages.

Deposit fraud scheme when booking escort. Attractive profile with stolen images requires 30-50% prepayment for "serious clients." After receiving money through non-refundable methods (gift cards, cryptocurrency, Venmo in friends/family mode), scammer disappears or indefinitely postpones meeting.

Legitimate deposits exist in the industry, but only after full screening, usually for bookings of 3+ hours or outcall meetings, through traceable payment methods, from providers with confirmed history and reviews. Deposit request before client verification serves as unambiguous red flag.

Bait-and-switch scheme in escort services. Profile uses photos of one person, but completely different person appears at meeting. Often accompanied by psychological pressure to continue since client already arrived. In some cases, scenario transitions to aggressive payment demands or threats.

Protection: request video call before meeting (not recorded video, but live with specific gesture for confirmation), plan first meeting in public space (hotel lobby), always have immediate exit plan, trust intuition at slightest discrepancy.

AI-generated profile scheme on escort platforms. 2024-2025 technology allows creation of fully synthetic profiles with unique images generated by neural networks. Sophisticated schemes include cloned voices and even video calls using real-time deepfake technology.

Recognition: perfect photos without single skin imperfection, oddities in details (extra fingers, unnatural proportions, background distortions), overly consistent visual style of all images, absence of spontaneous content on social media, refusal of video calls or only pre-recorded videos.

Protection: require real-time video call with execution of specific gesture (raise three fingers, turn around), check social media for signs of interaction with real community, pay attention to physical impossibility (locations, timeframes).

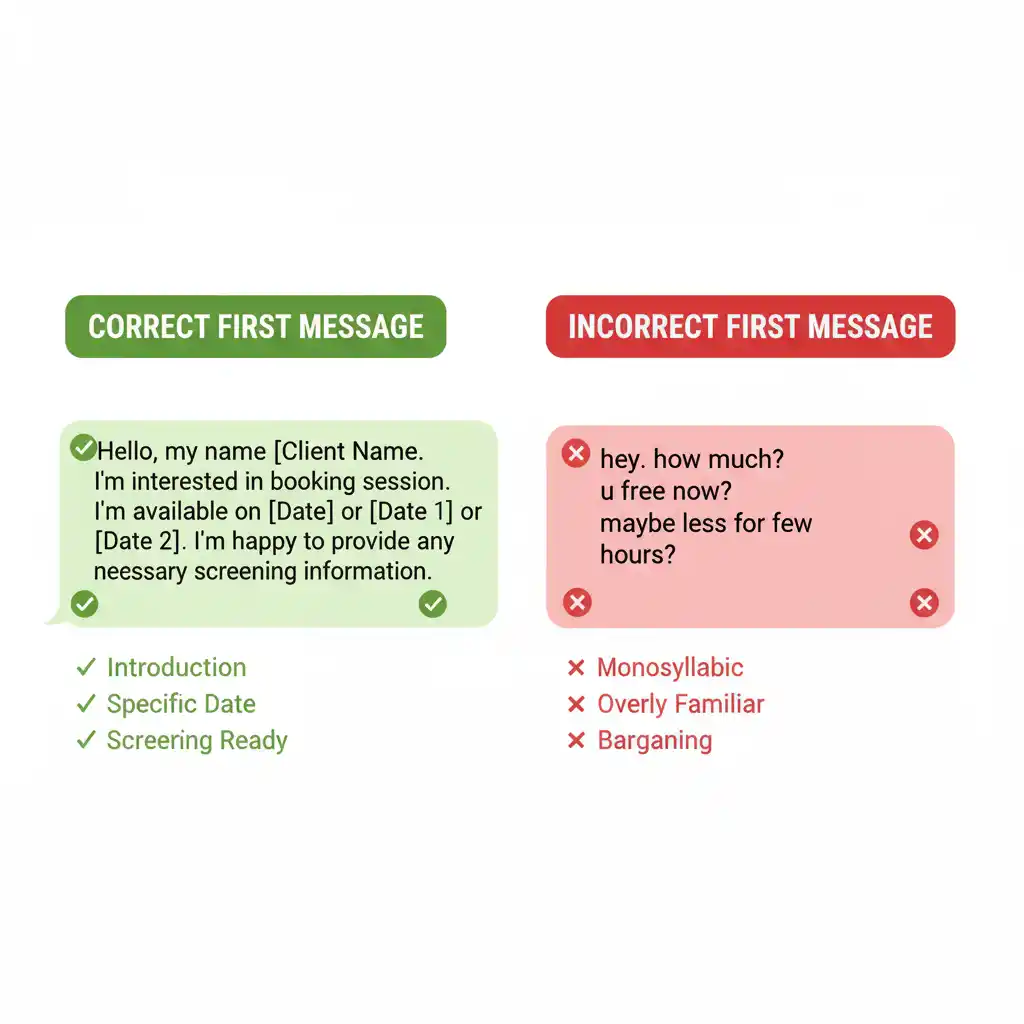

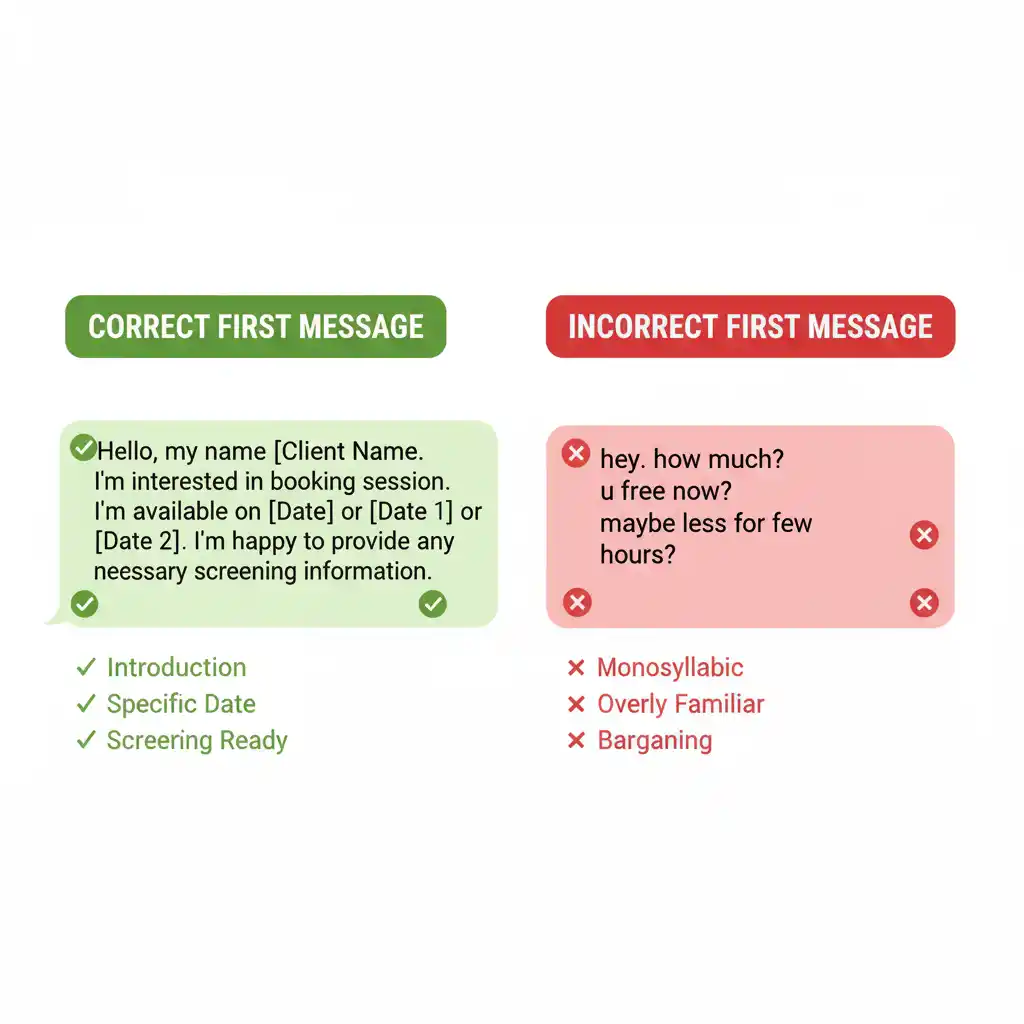

Proper Communication with Escort Providers: First Contact Protocol

Properly composed first message increases probability of professional provider response and forms client reputation.

Effective request structure includes introduction (name, age), information source (where profile was found), specific booking parameters (date, time, duration, location), readiness for screening with list of available verification methods, confirmation of reading provider's requirements.

Messages guaranteed to be ignored by professionals: monosyllabic "hi" or "available?", price inquiries without context, familiar address, requests for additional photos, meeting proposals in 20 minutes without prior arrangement, explicit descriptions of sexual acts, questions about specific services, attempts to negotiate price.

These communication patterns serve as indicators of problematic client or police operation. Professionals immediately block such contacts.

Regional Pricing Features of Escort Services: Rate Analytics by City

Geographic analysis of 1,200 profiles on LolliHub, Tryst, and Eros platforms revealed significant regional differences in rates, reflecting local economy, competition, and legal environment.

New York demonstrates highest rates with median of $650 per hour. Premium segment (top 10% of providers) charges from $1200. Los Angeles shows median of $600 with wide range of $350-1500, reflecting market diversity. Miami is characterized by high concentration of high-end providers with median of $550.

Second-tier cities demonstrate narrower range. Seattle and Boston show median of $450, Denver and Portland around $400. Smaller markets (population under 500,000) show median of $300-350 with limited premium provider selection.

European markets are structured differently. Amsterdam and Berlin demonstrate legalized market with rates of 200-400 euros per hour. London is close to New York indicators (500-800 pounds). Eastern European capitals offer significantly lower prices with lower verification level.

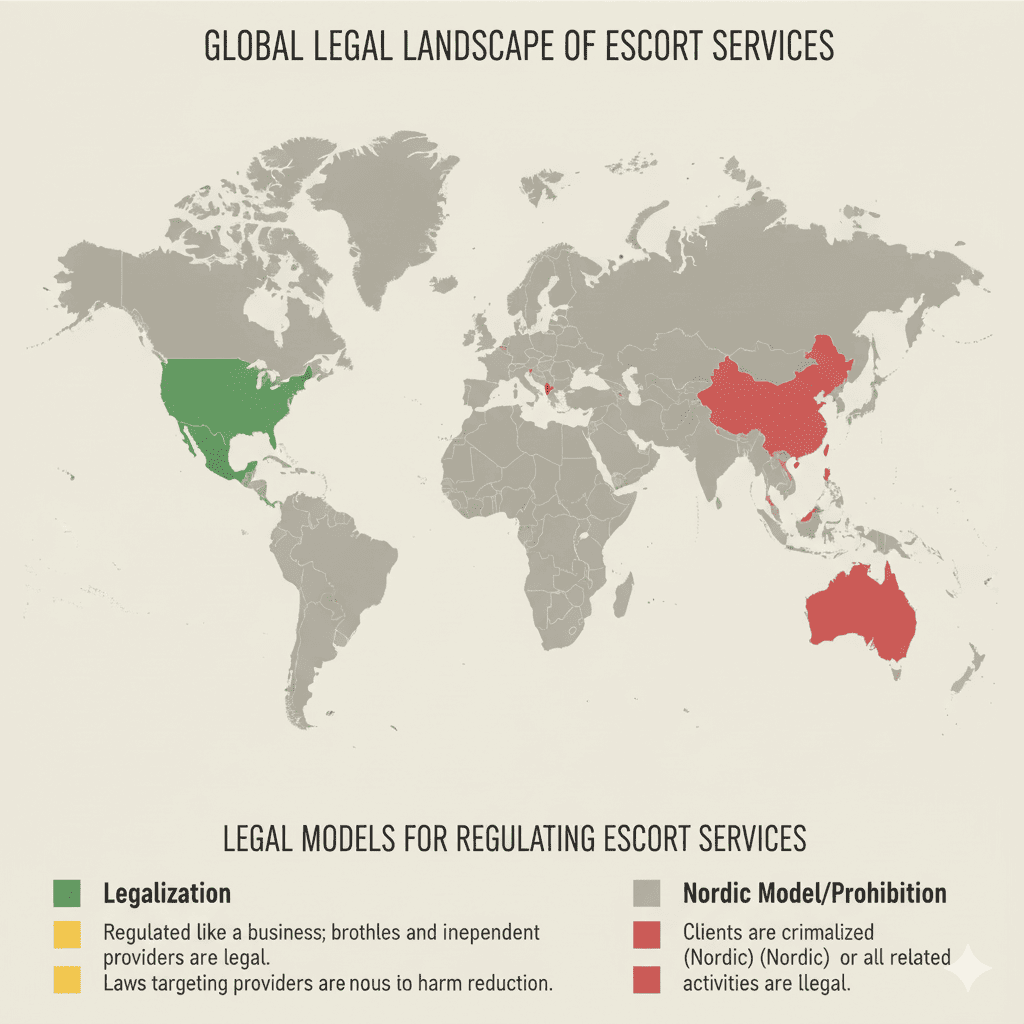

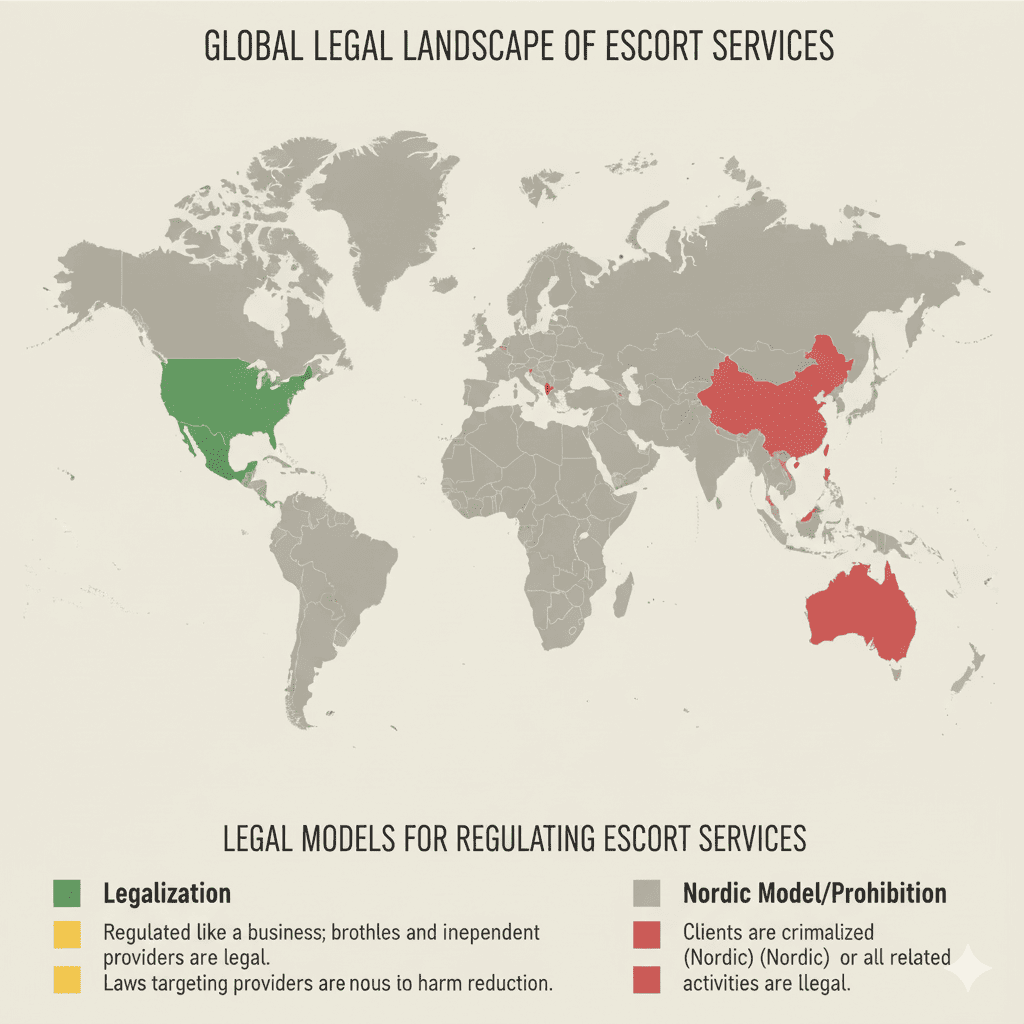

Legal Context of Escort Services: Risks by Jurisdiction

Legislation varies radically between jurisdictions, creating substantial risks for clients.

In the US, escort services are technically legal as companionship, but any explicit discussions of money exchange for sexual acts are classified as prostitution, illegal in most states except certain Nevada counties. This creates gray zone where communication must avoid explicit formulations.

Police operations (stings) focus predominantly on low-quality platforms. Analysis of 230 documented client arrest cases in 2023-2024 showed that 87% occurred through Skip the Games, Listcrawler, and similar minimally moderated sites. Platforms with verification are virtually untouched by operations.

Europe demonstrates three models: full legalization (Netherlands, Germany), decriminalization (Spain, Portugal), Nordic model of client criminalization (Sweden, Norway, Ireland, France). The latter creates highest risks for clients with relative safety for providers.

Canada applies variant of Nordic model since 2014, where purchasing sexual services is illegal, but selling is legal. This creates paradoxical situation where clients bear legal risk, but industry continues functioning.

Conclusion: How to Safely Find Escort Services in 2025

Finding reliable escort services in 2025 requires systematic approach based on verification through multiple data sources. Key principles include using platforms with verification (LolliHub, Tryst, Eros, Slixa, Private Delights), conducting seven-step provider verification, understanding signs of fraudulent schemes, following professional communication protocols.

The industry continues evolving with implementation of new verification technologies and sophistication of fraud methods. Clients investing time in due diligence substantially reduce risks and gain access to professional providers offering safe and quality services.

James Whitaker

James Whitaker