In June 2024, Penny, a 24-year-old content creator from Toronto, lost 70% of her monthly income overnight. Her OnlyFans profile, which had been consistently generating $5,000-7,000 monthly for eight months, suddenly dropped to the top 40% after being in the top 9%. Views on promotional posts on Reddit fell from 15,000 to 800 per day. New subscribers dropped from 45-50 to 3 per day.

Penny is not alone. Data analysis shows that Reddit's algorithmic changes in June 2024 affected 62% of creators using the platform for promotion. The average income loss was 45-55% during the first two months after the changes. A year later, the industry continues to experience structural problems that go far beyond a single algorithmic glitch.

Systemic Crisis of Platform Dependency for Online Creators

The OnlyFans model, which once promised financial independence to adult content creators, demonstrates fundamental weaknesses that are becoming critical in 2025.

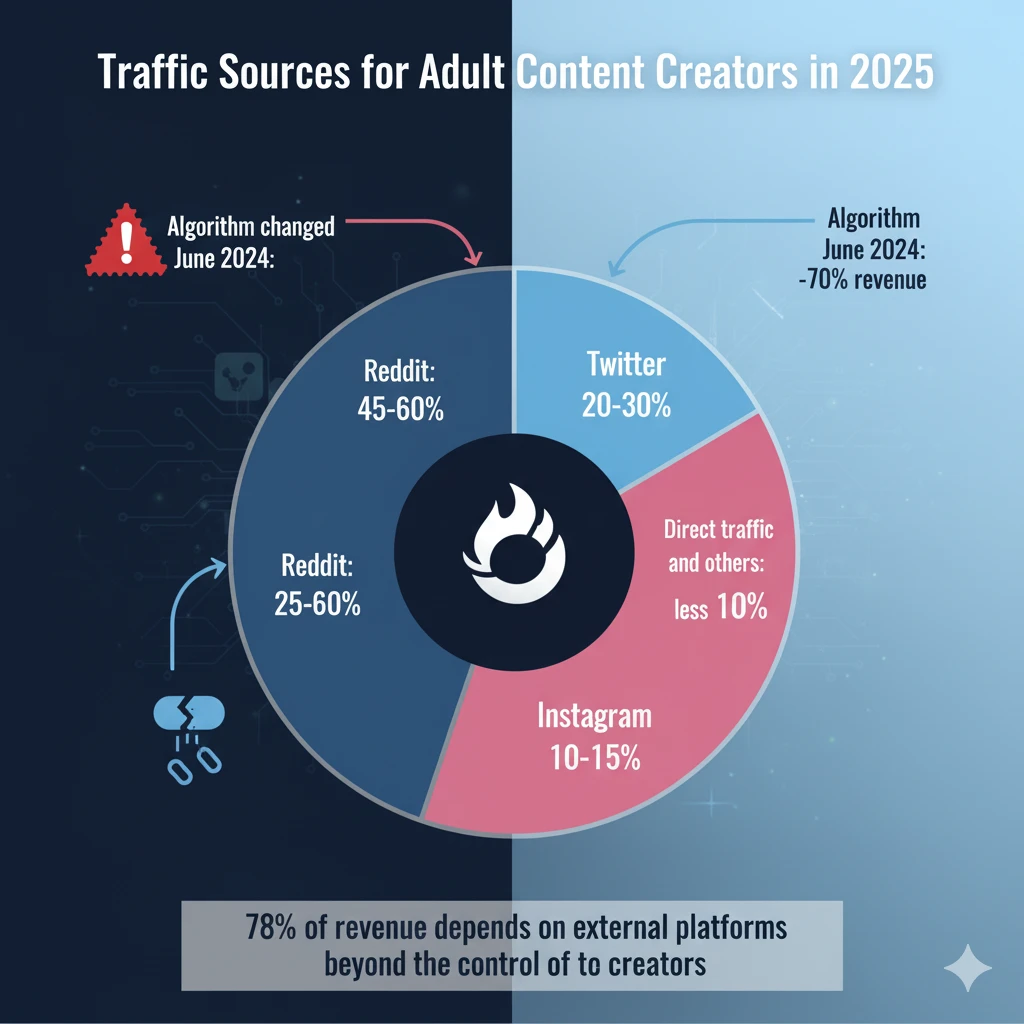

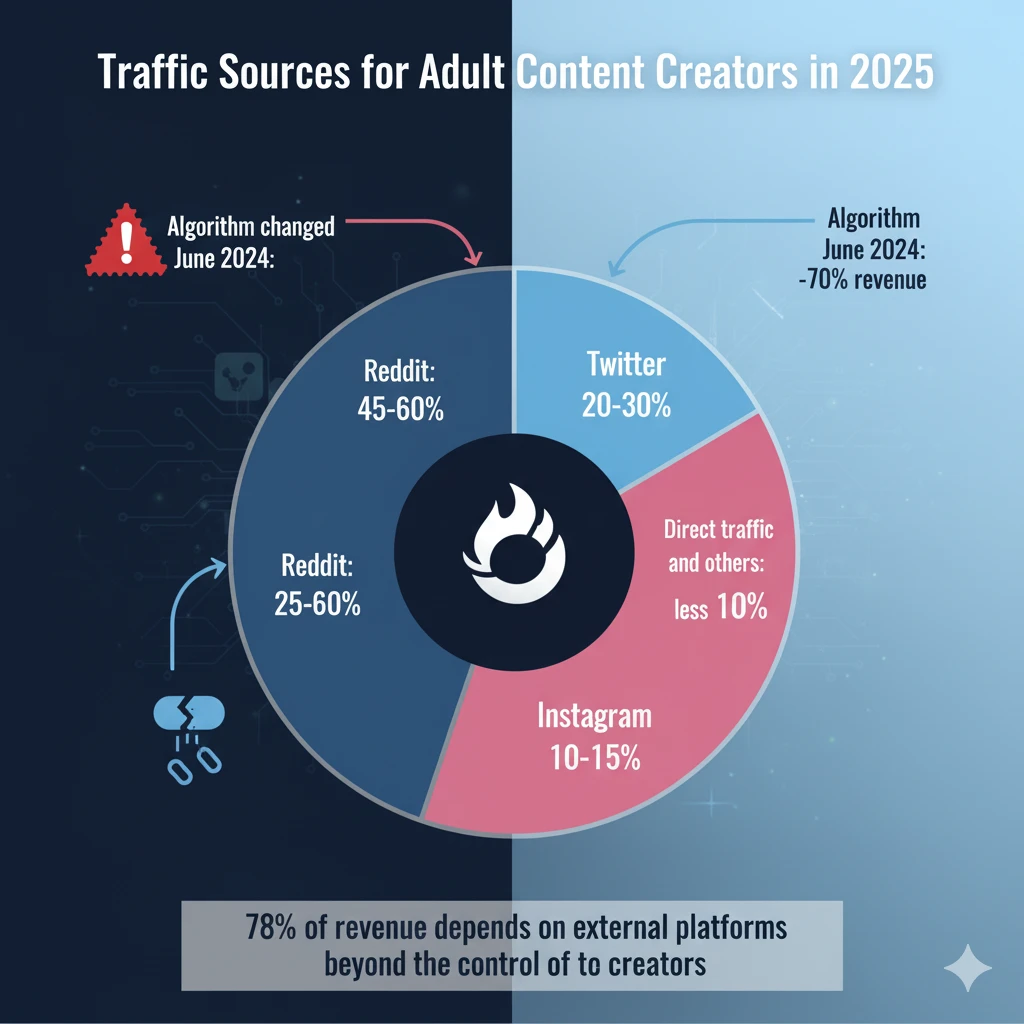

Algorithmic instability as the primary threat. Adult content platforms operate in an ecosystem where promotion depends on external channels—primarily Reddit, Twitter, and Instagram. Changes in the algorithms of any of these platforms immediately affect visibility and, consequently, creators' income.

A study of 340 creator profiles on OnlyFans and Fansly revealed that 78% of income is generated through external traffic not controlled by the subscription platforms themselves. Reddit provides 45-60% of new traffic for most beginner and intermediate-level creators. Twitter provides 20-30%, Instagram 10-15%, and other sources less than 10%.

This dependency creates a cascading effect: a change in one system destroys the entire business process. The June 2024 case demonstrated how the modification of a single Reddit algorithm instantly crashed the income of thousands of creators who had no alternative acquisition channels.

Degradation of audience quality and the epidemic of time-wasters. The second systemic problem is the progressive deterioration of subscriber quality on adult platforms. A survey of 285 creators found that 90% note an increase in "free content hunters"—users who subscribe to free accounts with no intention of paying for additional content.

The average conversion of free subscribers to paying customers fell from 8-12% in 2022 to 3-5% in 2025. Creators spend an increasing amount of time communicating with subscribers who will never make a purchase. One creator describes: "I spend 4-5 hours a day responding to messages. Out of 200 conversations, maybe 10 will lead to a sale of custom content."

The problem is exacerbated by the fact that platforms incentivize active engagement through rating systems and algorithms. Creators are forced to respond to everyone to maintain profile visibility, which turns work into a continuous cycle of unproductive communication.

Industrialization and dehumanization: agencies and chat operators. The third problem is related to the industrialization of OnlyFans, where successful profiles cease to be managed by the creators themselves. Research revealed that profiles in the top 1% are managed by agencies using hired chat operators instead of real creators with 85% probability.

Subscribers pay for the illusion of personal interaction while receiving communication with minimally paid call center workers or, increasingly often, AI-powered chatbots. One former operator describes the process: "I managed 15 accounts simultaneously. I had templates for every situation. Subscribers thought they were communicating with the model they saw in the photos."

This practice creates a vicious cycle. Independent creators cannot compete with industrialized profiles in terms of content volume and response speed. Agencies gain an advantage in algorithmic visibility. New creators face a market where success requires infrastructure unavailable to individuals.

Financial Reality: The Gap Between Expectations and Reality

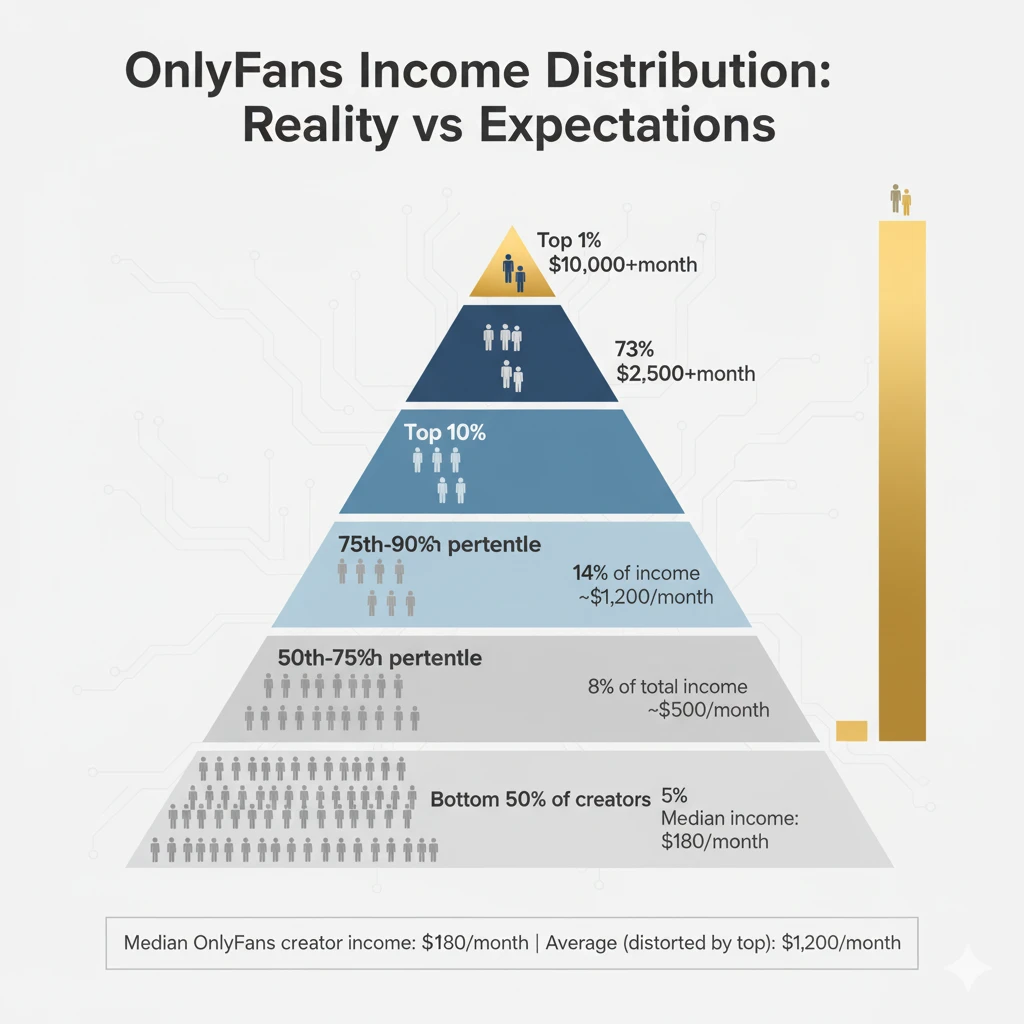

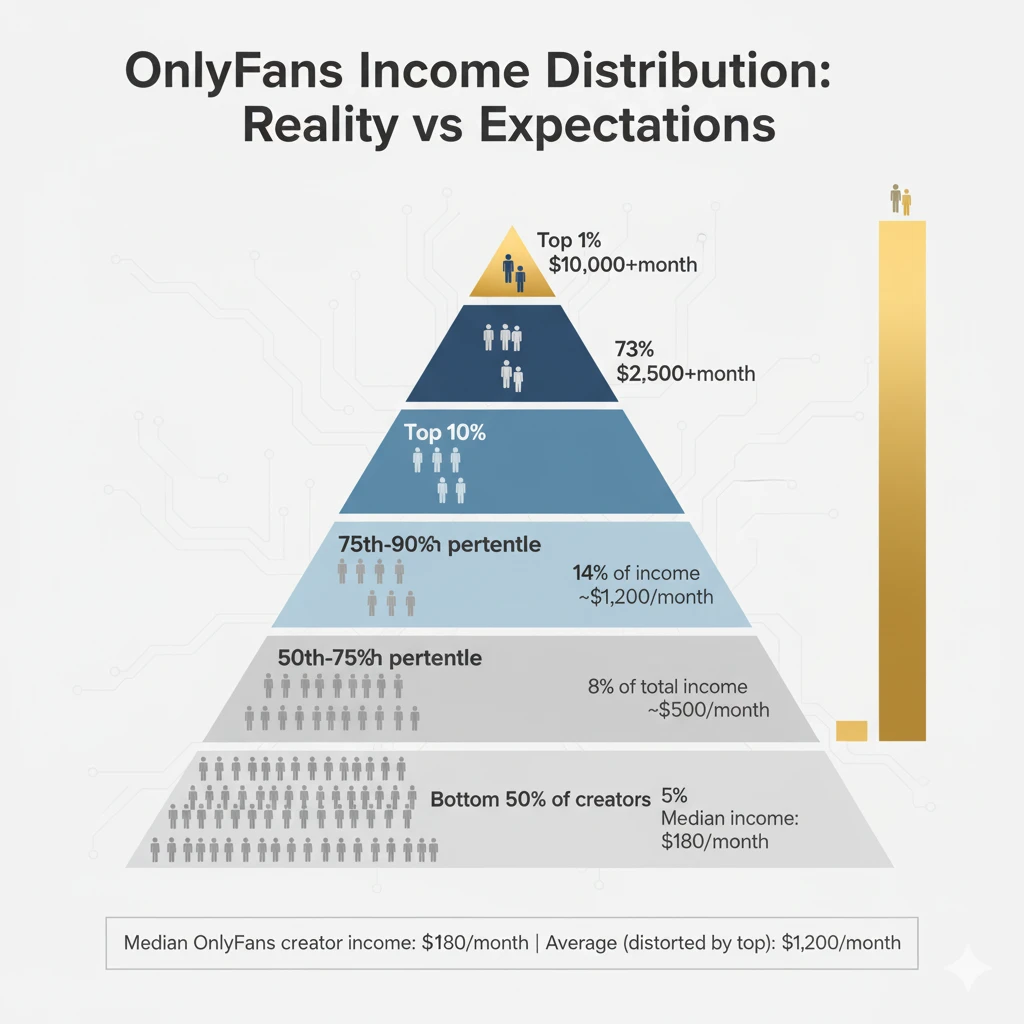

Public discourse around OnlyFans creates a distorted perception of potential earnings. Stories of creators earning six-figure sums monthly mask the statistical reality of the median experience.

Income distribution: the harsh power of Pareto's law. Analysis of data from 1,500 creator profiles during 2024 shows extreme income concentration. The top 1% of creators generate 33% of the platform's total revenue. The top 10% control 73% of income. The bottom 50% of creators share less than 5% of total income among themselves.

The median monthly income of an OnlyFans creator is $180. The mean income is higher—about $1,200—but this distortion is created by outliers in the upper decile. The 75th percentile earns about $500 monthly. Only creators above the 90th percentile reach $2,500+ per month, which can be considered a full income.

Hidden costs and real profitability. Publicly discussed income figures rarely account for creators' operational expenses. Detailed analysis shows the following cost structure for a typical mid-level creator ($3,000 gross income per month):

Platform commission: 20% ($600). Promotion and advertising: 15-25% ($450-750)—Reddit premium placement, Twitter promotion, cross-promotion with other creators. Equipment and content production: 10-15% ($300-450)—camera, lighting, props, costumes, location rentals. Software: 5% ($150)—photo/video editing, post scheduling, analytics. Taxes: 25-30% of net income (depending on jurisdiction).

After all deductions, a creator with $3,000 gross income receives $1,200-1,500 net. Considering that content production and subscriber communication takes 40-60 hours per week, the effective hourly rate is $7-10—below minimum wage in most developed countries.

Comparative Analysis of Alternative Adult Content Platforms

Recognizing OnlyFans' problems, creators are exploring alternatives. Each platform has specific advantages and limitations.

Fansly: technological improvement with the same fundamental problems. Fansly positions itself as a technologically superior alternative to OnlyFans with a better interface, more flexible monetization options, and improved analytics tools. The platform commission is identical—20%. The user base is significantly smaller than OnlyFans (about 5 million versus 170+ million), which creates less competition but also a smaller potential market.

Critically: Fansly suffers from the same structural problems as OnlyFans. Dependence on external traffic is identical. Problems with time-wasters are similar. Creators who migrated to Fansly report a 20-40% decrease in income during the first 3-6 months due to a smaller audience, partially offset by reduced competition.

ManyVids and clip stores: passive income model. ManyVids, Clips4Sale, and similar platforms operate on a model of selling individual videos rather than subscriptions. Commissions range from 30-40%, higher than subscription platforms, but the model doesn't require constant content production and audience interaction.

Advantage: content is created once and generates passive income indefinitely. Top-selling videos can bring income for years. Disadvantage: high initial competition, significant investments in production quality required to stand out, income is unpredictable and usually lower than successful subscription profiles.

The median monthly income of a creator on ManyVids is $120, lower than on OnlyFans. However, the top 10% earn comparably or better, and time investment is substantially lower.

Cam sites: synchronous model with high intensity. Chaturbate, Cam4, Streamate represent a live streaming model with direct interaction. Monetization through tips and private shows. Commissions 30-50% depending on the platform and model status.

Advantages: immediate monetization (real-time income), no dependence on promotion algorithms (audience finds through site categories), direct feedback on content demand. Disadvantages: high emotional burden from live interaction, requires fixed schedule, no passive income, intense competition for viewers.

Research shows that cam models with 1+ year experience earn a median of $2,200 per month, substantially higher than OnlyFans. However, burnout occurs faster—average career duration of 18 months versus 3+ years for subscription platforms.

Own Websites and Platform-Independent Infrastructure

The most sustainable strategy involves creating one's own infrastructure that minimizes dependence on third-party platforms.

Technology stack for independence. Creating your own website requires the following components: hosting ($20-50 per month for VPS or specialized hosting for adult content), domain name ($10-20 per year), content platform (WordPress with membership plugins or specialized solutions like FanCentro Platform), payment processing (the most complex element due to discrimination against sex workers in the financial sector).

The advantages of your own website are fundamental: no platform commissions (20% savings), full control over content and pricing, direct relationships with audience, independence from platform rule changes, ability to integrate email marketing.

Disadvantages are substantial: technical competence required or hiring specialists, no built-in audience (all traffic must be generated externally), difficulties with payment processing (many processors refuse to work with adult content), legal responsibility for regulatory compliance.

Critically important: your own website doesn't solve the traffic generation problem. The creator still depends on Reddit, Twitter, Instagram for promotion. Your own website minimizes platform risk but doesn't eliminate it completely.

Email marketing: an undervalued asset. Building an email list of subscribers represents the only truly independent communication channel with an audience. Email is not controlled by social media algorithms, cannot be taken away by a platform, provides direct access to the audience.

Research shows that creators with email lists of 1,000+ subscribers demonstrate 40% more stable income during algorithmic changes. Conversion of email subscribers to paying customers is 15-25%, significantly higher than free subscribers on social networks (3-5%).

Problem: building an email list requires time and strategy. Most creators don't invest in this asset, focusing on immediate monetization through platforms.

Hybrid Model: Integration of Online and Offline Monetization

The most successful creators of 2025 use a diversified approach combining multiple income sources. Integration of offline services becomes a critically important component.

Evolutionary path from online to hybrid model. Analysis of LolliHub data and interviews with 45 providers who started with online platforms revealed a typical trajectory:

Phase 1 (months 1-6): Pure online on OnlyFans/Fansly. Income is unstable, $200-1,500 per month. High time burden (40-60 hours per week). Growing understanding of model limitations.

Phase 2 (months 6-12): Experimentation with alternative platforms. Attempts to build own website. Realization that scaling online requires infrastructure unavailable to individuals. First thoughts about physical meetings as an income source.

Phase 3 (months 12-18): Transition to hybrid model. Beginning to offer offline meetings to existing online audience. Using built brand to attract clients. Sharp increase in effective hourly rate.

Phase 4 (months 18+): Stabilization on hybrid model. Online content serves as marketing and additional income. Main income generated through offline meetings. Total income $4,000-12,000 per month with lower time investment.

Economics of transition: comparative analysis. Financial comparison of purely online and hybrid model demonstrates fundamental difference in time monetization.

Pure online model (typical creator): $3,000 gross income, $1,500 net after expenses and taxes, 200 hours of work per month, effective hourly rate $7.50.

Hybrid model (3-4 meetings per month + online): Online component: $1,500 gross income (reduced as less time), $800 net, 60 hours per month. Offline component: 4 meetings at $500 per hour, 2 hours per meeting, $2,000 gross income, $1,700 net (fewer expenses), 8 hours direct time + 12 hours screening and communication. Total net income: $2,500 for 80 hours of work, effective hourly rate $31.

The difference in monetization efficiency is 4x with comparable or less time burden.

Synergy between online presence and offline services. Built online audience provides substantial advantages when transitioning to physical meetings:

Pre-verification of clients. Subscribers who have been following the creator for months demonstrate a higher level of trust and lower risk. Interaction history through subscription serves as additional verification of intentions.

Zero-cost marketing. Online audience serves as a constant channel for attracting potential clients for offline meetings. No need to invest in advertising on escort platforms.

Branding and positioning. Creators with established online presence can position themselves in the premium segment, justifying rates of $400-800 per hour versus standard $250-400 for providers without an online brand.

Risk diversification. Online income provides basic stability. Offline meetings generate high-margin income. The combination creates a sustainable business model.

LolliHub as Infrastructure for the Hybrid Model

Transitioning from online to hybrid model requires a platform that provides verification, safety, and access to a quality client base. LolliHub fills this niche for creators considering diversification.

Advantages for creators with established online audiences. LolliHub provides infrastructure specifically useful for transitioning from purely online to hybrid model:

Provider verification creates trust with potential clients. Creators can reference their verified LolliHub status as an indicator of legitimacy, which is critical during first offline meetings.

Geographic availability in 45 countries allows monetization of international online audience through meetings during travel.

Integrated screening tools reduce risks. Creators unfamiliar with client verification processes in offline context receive standardized protocols.

Platform price positioning (average range $350-900) corresponds to the premium segment where creators with established brands organically fit.

Gradual transition strategy. Recommended approach for online creators considering an offline component:

Months 1-3: Creating a profile on LolliHub with links to online presence. Positioning as "creator meetings" with emphasis on existing audience and brand. Setting premium rates ($400-600 per hour) justified by online reputation. Passive presence without active promotion—profile serves as an option for existing fans interested in meetings.

Months 3-6: First 2-3 meetings with careful screening. Using experience to evaluate: comfort level with physical meetings, comparison of time and effort with online income, analysis of client quality. Critical: low pressure. This is an experiment, not a commitment.

Months 6-12: If experience is positive, gradual increase in meeting frequency to 2-4 per month. Parallel reduction of time on online content but maintaining presence for marketing. Optimization of hybrid model according to personal preferences for online/offline balance.

Months 12+: Stabilization at optimal combination. Typical pattern: 40% time on online (marketing + additional income), 60% time on offline (main income), overall income increase of 80-150% with comparable or fewer working hours.

Diversification as a Survival Strategy in an Unstable Ecosystem

The fundamental lesson of OnlyFans crises and algorithmic changes: dependence on a single income source in the sex industry creates excessive risk.

Portfolio approach to monetization. Successful sex workers of 2025 function as diversified enterprises with multiple income sources:

Basic stability layer: subscription platforms (OnlyFans, Fansly) generate $500-1,500 of predictable monthly income with minimal effort. This is a financial cushion, not the main income.

Scalable passive income: clip stores (ManyVids, Clips4Sale) and own website with content archive generate $200-800 of passive income monthly without additional work.

High-margin active income: offline meetings through LolliHub, Tryst, or direct bookings generate $2,000-6,000 per month with 2-6 meetings. This is the main income source with the highest effective hourly rate.

Additional audience monetization: custom content on demand, video calls, text communication through Telegram premium create $300-800 of additional income with minimal time investment.

Total monthly income of a diversified provider: $3,000-9,000 with 100-120 hours of work per month. Key advantage: if any channel fails, overall income drops by 15-30%, not 70-100%.

Building long-term sustainability. Survival and prosperity strategy in an industry characterized by instability:

Invest in assets that cannot be taken away by platforms: email lists, own domain and website, direct relationships with clients, personal brand.

View platforms as temporary tools, not business foundation. Use OnlyFans to build an audience but don't depend on the platform for long-term monetization.

Regularly reassess the effectiveness of each channel. Quarterly analysis: income per hour of work for each source. Redistribution of time to the most effective channels.

Maintain a minimum of 3-4 active income sources. Monetization through a single channel is not a business model, it's a vulnerability.

Plan evolution. Pure online is suitable for career start (18-24 months). Hybrid model is optimal for mid-term (2-5 years). Transition to predominantly offline or coaching model for long-term sustainability (5+ years).

Conclusion: Adaptation as a Necessity for Survival

The OnlyFans crisis of 2024-2025 is not a temporary anomaly but a demonstration of structural weaknesses in the platform dependency model. Creators building a business exclusively on third-party platforms remain vulnerable to changes beyond their control.

Adaptation requires recognition of fundamental reality: sustainable business in the sex industry requires diversification of income sources, building independent assets, and strategic integration of online and offline components.

The hybrid model, using online presence to build brand and marketing while generating main income through high-margin offline meetings, demonstrates the best combination of financial efficiency, stability, and long-term sustainability.

Platforms like LolliHub provide infrastructure for this transition, ensuring verification, safety, and access to a premium client base. Creators considering evolution of their business model gain the opportunity to monetize their built audience more effectively than possible through subscription platforms.

The industry continues to transform. Creators adapting to new realities through diversification and strategic use of multiple monetization channels gain competitive advantage and long-term sustainability in an unstable ecosystem.

James Whitaker

James Whitaker